Borrow 40000 mortgage

Primary Residence Estimated property value. Lets say you just purchased a home for 300000 and made a 40000 down payment.

Can You Borrow From Life Insurance To Buy A Home Life Ant

In 2021 the reverse mortgage line of credit continues to be the most popular option for homeowners when choosing how to access their funds.

. So if you only borrow 20000 on a kitchen renovation thats all you have to pay back not the full 30000. Extended-term rates available and may vary based on creditworthiness. A standard mortgage requires a 20 down payment.

No small amount of money to save. Available to qualifying Members. Can You Borrow From Life Insurance to Buy a Home.

40000 down payment 300000 home price 1333 down payment. 350000 home value200000 amount to borrowFirst-time buyerAll rates20. Speak to an expert mortgage broker and get independent advice.

Your credit score could range from excellent 800 and above to poor 350 579 and its all based on your credit history among other factors. 5 6 APR Annual Percentage Rate. A mortgage is one of the biggest commitments youll make in your financial life.

A home equity loan works a lot like a mortgage. Our mortgage calculator helps by showing what youll pay each month as well as the total cost over the lifetime of the mortgage depending on the deal. What is the BER of.

It can be tempting to borrow your maximum mortgage amount and buy the most expensive property you can afford but that may not be the right thing to do. Up to 30 years. For example if your homes current value is 200000 youd need to have at least 30000 to 40000 in equity depending on the lenders requirements.

With this example you could borrow up to. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you can borrow. Your credit score is a three-digit number that represents the amount of risk a lender takes on when you borrow money.

You use it to borrow cash from your property. 240000 minus 200000 equals 40000. You must not borrow money for your down payment this requirement is unchanged from July 2020.

A closed mortgage allows limited lump-sum prepayments and includes penalties if you pay the loan ahead of schedule. Income for a 200000 mortgage. Rate subject to change without notice and based on creditworthiness.

If you are doing a cash-out refinance you will need to retain 20 percent equity so that gives you 40000 available to borrow. Can I use a home equity loan for. This means you can borrow up to 30000 but no more.

April 13 2022. If you have 40000 of equity you might qualify for a HELOC with a maximum spending limit of 30000. But with so many possible deals out there it can be hard to work out which would cost you the least.

How much can I borrow. Use our Lenders Mortgage Insurance Calculator to calculate how much LMI you may need to pay. This mortgage finances the entire propertys cost which makes an appealing option.

Reverse Mortgage Line of Credit. However as a drawback expect it to come with a much higher interest rate. According to an article by AARP borrowers recognized this choice at about 66 of the time when obtaining a reverse mortgage as being the right choice for them.

This would allow you to cash outreceive a 40000 check minus any closing costs. Some restrictions may apply. Amount to borrow 40000.

A close mortgage will generally have lower interest rates because of the limitations placed on the payment. Say you raised a deposit of 40000. A home equity loan is a second loan thats separate from your mortgage and allows you to borrow against the equity in your home.

To take cash out you usually need to leave 20 equity 40000 in the home. Your mortgage specialist would be happy to explain this in detail to you. Weve done some calculations to show you the range of incomes that might get you approved for a 200000 mortgage.

RBC Royal Bank mortgages advanced after April 15 1996 automatically include this money-saving feature allowing you to avoid the legal costs usually associated with adding onto your mortgage. Assuming an income of 150000 and all other things being equal a longer-term loan increases the amount you can borrow by about 40000 according to the HSH calculator. Even though there are programs to help lower down payments most people will need more than 10000 to 20000 in cash between the down payment closing.

To borrow that amount you would take out a new mortgage for 160000 120000 already owed plus 40000. Aside from the borrower their parents or family member also takes. Assuming you are a first-home buyer who are planning to buy a 800000 home and borrow with only a 15 deposit 120000 you will need to pay around 8700 for LMI.

The maximum loan amount is 40000 with a potential additional 10000 grant for older very-low-income homeowners if its used to remove health and safety hazards in the home. 100 percent mortgages are a type of guarantor mortgage geared toward buyers who cannot afford a home on their own. Minimum loan amount for new auto loans with terms 85 to 96 months.

Single family home Property Use. Your mortgage default insurance premium would be calculated as follows. We bring over 80 years of experience with local processing.

Which one to choose is a matter of preference. An open mortgage allows you to pay back the loan in full at any time. We calculate this based on a simple income multiple but in reality its much more complex.

Georgias Own offers affordable mortgage loan terms rates and pricing. In a 200000 home this is 40000. Speak to an expert mortgage broker and get independent advice.

If you were to refinance your home with a new loan amount of 160000 youd get to pocket 60000 minus closing costs and fees. As with a credit card you only pay back what you borrow.

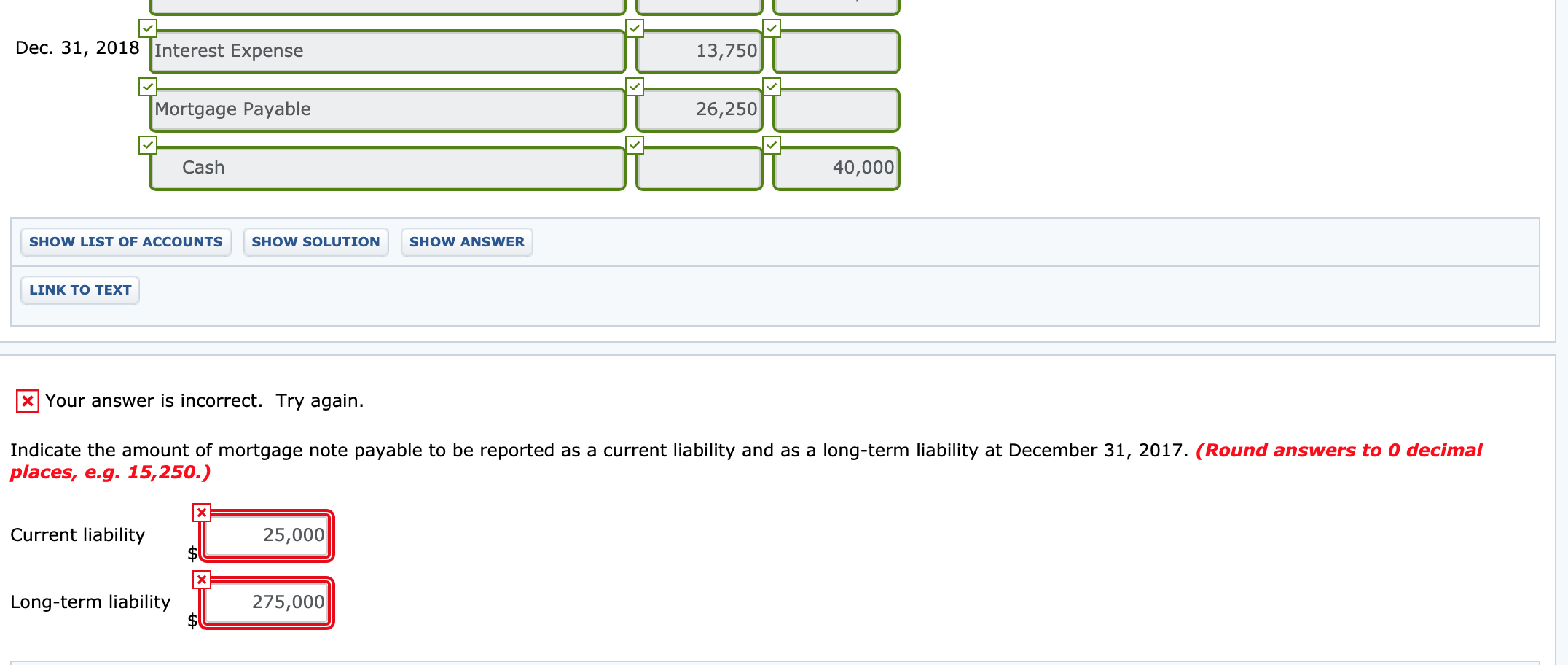

Solved Exercise 15 10 Dreiling Company Borrowed 300 000 On Chegg Com

Mortgage Affordability Calculator Trulia

Solved Exercise 15 10 Dreiling Company Borrowed 300 000 On Chegg Com

A Complete Guide To Second Mortgages

/business-with-customer-after-contract-signature-of-buying-house-957745706-c107ad59288c4de0b56d10315c08c67a.jpg)

How To Improve Your Chance Of Getting A Mortgage

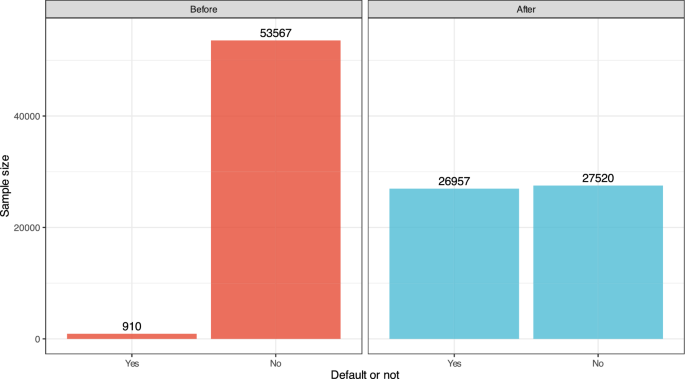

Loan Default Prediction Of Chinese P2p Market A Machine Learning Methodology Scientific Reports

Xoxkyz Gxcrmwm

What Is The Average Down Payment On A House Sofi

Borrow Secu Credit Union

Where To Get A 10 000 Personal Loan Credible

Texas Mortgage Calculator Nerdwallet

40 000 Loan Calculator Eligibility Check Finder Com

How To Qualify For A Personal Loan Without Putting Up Collateral Student Loan Hero

Mortgage Affordability Calculator Trulia

Mortgage Affordability Calculator Trulia

Vacation Home Mortgage Calculator Vacation Property Online

Georgia Mortgage Calculator Nerdwallet